“Divorce is the one human tragedy that reduces everything to cash.” (Rita Mae Brown)

How will the new “Three-Pot Retirement System” (often referred to as a “Two-Pot System”) affect financial arrangements on divorce? Retirement savings can amount to a significant portion of a marriage’s assets, so it’s important to understand the implications of the new system.

First, a quick refresher

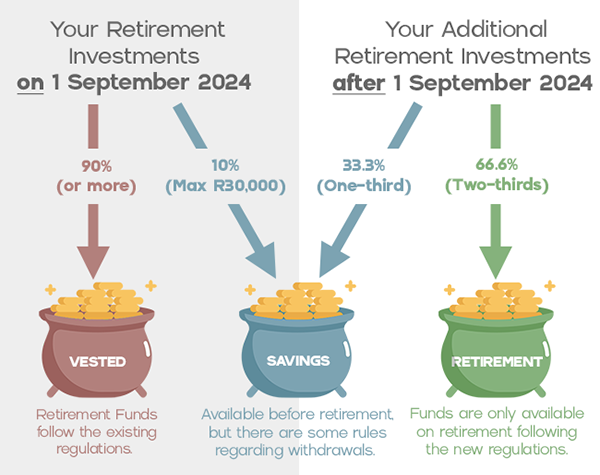

Have a look at our graphic below for a neat summary of the three “pots” and what they’re all about.

- The “Vested Pot”: This will hold most of your existing (as at 1 September 2024) retirement investments, and the current regulations continue to apply.

- The “Savings Pot”: You will be able to withdraw funds from this pot before you retire. Rules apply and you should avoid depleting this pot except in real need.

- The “Retirement Pot”: You will (with only a few limited exceptions) only have access to these funds when you reach retirement age (usually 55, depending on the fund).

What happens to these three pots on divorce?

This is of course a brand-new system, and there have been concerns raised about a number of grey areas that may arise in a divorce context. Only time will tell if these will have any meaningful practical effect on divorcing spouses. These exceptions aside, the overriding sentiment seems to be that not much will change other than that your marriage’s “pension interests” will be made up of three distinct pots, rather than just the current one pot.

As such, all three pots will be dealt with as follows:

- If you are married in community of property, they will be divided equally between you.

- If you are married out of community of property with the accrual system, they will fall into the accrual calculations unless you expressly excluded them in your ante-nuptial contract.

- If you are married out of community of property without the accrual system, they might still be taken into account if the court orders an asset redistribution.

And remember, you can always agree between yourselves on a different split upfront in your ante-nuptial contract or on divorce in a settlement agreement.

One new risk to manage

Until now, there has been no “Savings Pot” for a member spouse to potentially deplete as soon as the possibility of divorce raises its ugly head.

While we all know that families should never risk missing their retirement goals by dipping into their long-term savings in any but genuine emergencies, it goes without saying that an acrimonious divorce could quickly change the focus from “let’s save for the future” to “grab it while you can”.

If the worst happens and your marriage hits the skids, be aware that the new legislation states that only when pension funds are given formal written notice, with proof, of divorce proceedings or pending asset divisions, are they legally prohibited from allowing a withdrawal (or granting a loan or guarantee) without your consent as the non-member. That formal prohibition lasts until the divorce is finalised or a court order is issued.

Some have suggested that even before you get to that formal stage, you should alert the pension fund administrators that they should assess any withdrawal requests in light of possible future divorce claims. How that will actually play out in practice remains to be seen, but it is worth noting.

The new system is a lot to get your head around and it’s natural to have questions. Don’t hesitate to ask us for help!

Disclaimer: The information provided herein should not be used or relied on as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your professional adviser for specific and detailed advice.

© LawDotNews